How did the 1970s oil crises affect Southeast Asia?

Topic of Study [For H2 History Students]:

Paper 2: Economic Development after Independence

Section B: Essay Writing

Theme II Chapter 1: Paths to Economic Development

Historical context: The 1970s oil shocks

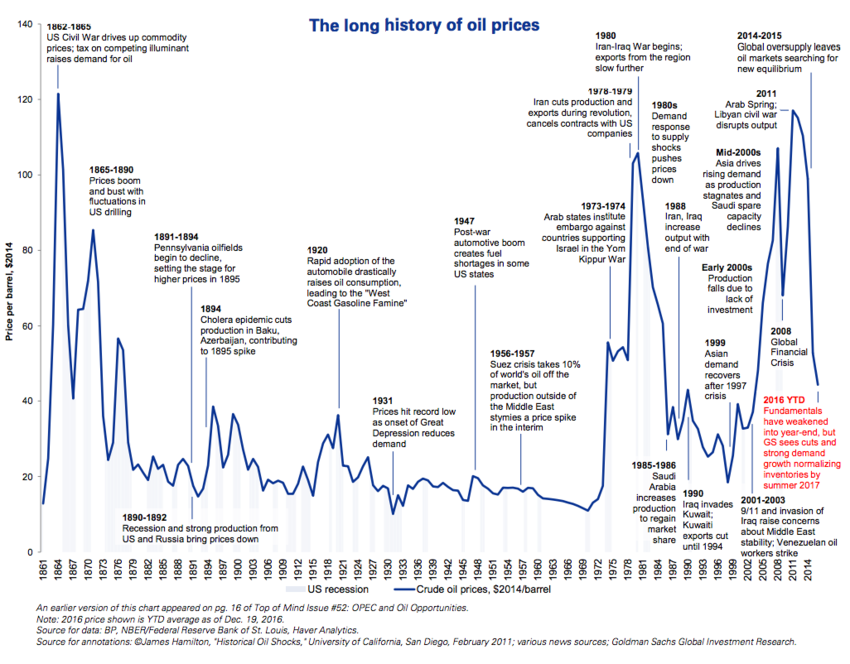

In the early 1970s, petrostates in the Arab world agreed to boycott Western nations, such as the USA and UK, for their provision of support to Israel during the Yom Kippur War against Egypt. As a result, crude oil prices quadrupled from $3 per barrel to $12 per barrel by 1974.

The second oil shock took place between 1978-1979, in which the Iranian Revolution concluded with the fall of the Shah’s regime. At that time, Iran was the world’s second-largest oil exporter. With the temporary halt in oil production in Iran, the political turmoil had further devastated the world oil markets, causing oil prices to surge to nearly $30 per barrel by early 1980.

A windfall in Indonesia: Surge of petrodollars

In Southeast Asia, oil exporting nations like Indonesia benefited from this unprecedented development, given their membership in the Organisation of Petroleum Exporting Countries (OPEC). The oil price in Indonesia increased from $1.67 per barrel in 1970 to $35 in 1981.

With large inflows of revenues from oil exports, the Indonesian government used these surpluses to correct its balance of payment deficits. Furthermore, the New Order government used the oil revenues to expand the manufacturing sector, particularly through import purchases of raw materials and capital goods. More importantly, President Suharto embarked on ambitious large-scale development programs in different parts of Indonesia, including Java.

Due to the higher oil revenues, the Indonesian government was able to undertake substantial public investments and expand and improve the efficiency of the public administration sector (for instance by raising the salaries of public servants) which, in turn, contributed to economic growth.

[…] After the early 1970s first foreign aid and then oil revenues were spent on rehabilitating and expanding the long-neglected physical infrastructure (particularly in rural areas) and transport infrastructure. This rapid expansion and improvement of the physical and transport infrastructure involved roads, railways, bridges, harbours, airports and communications.

An excerpt from “Emergence of a National Economy: An Economic History of Indonesia, 1800-2000” by Howard Dick, Vincent J. H. Houben, J. Thomas Lindblad and Kian Wie Thee.

A temporary setback: For oil-importing nations in Southeast Asia

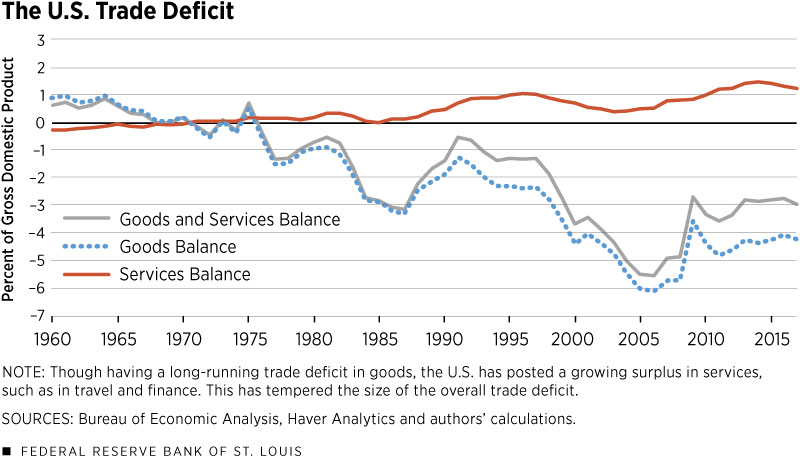

In contrast to Indonesia and Malaysia, oil-importing nations like Thailand, Malaysia, Singapore and the Philippines were adversely affected by the rise in oil prices. Higher oil prices meant a decline of the terms of trade as well as their balance of payment positions.

Thailand was hit harder by the second oil crisis and the subsequent world-wide recession because the country had become more dependent on external trade, and the external terms of trade were no longer favourable. […] The rate of inflation as measured by the consumer price index, which was 7 to 10 percent during the period 1977-1979, accelerated to 19.7 percent in 1980. Economic growth slowed somewhat to an annual growth rate of 7 percent in the 1970s, with the manufacturing sector growing at a higher-than-average rate of around 10 percent per annum.

An excerpt from “Economic Development in East and Southeast Asia: Essays in Honor of Professor Shinichi Ichimura” by Seiji Naya and Akira Takayama.

What can we learn from this article?

Consider the following question:

– How far do you agree that governments were responsible for the economic instability in independent Southeast Asia?

Join our JC History Tuition to learn more about the Paths to Economic Development. The H2 and H1 History Tuition feature online discussion and writing practices to enhance your knowledge application skills. Get useful study notes and clarify your doubts on the subject with the tutor. You can also follow our Telegram Channel to get useful updates.

We have other JC tuition classes, such as JC Math Tuition and JC Chemistry Tuition. For Secondary Tuition, we provide Secondary English Tuition, Secondary Math tuition, Secondary Chemistry Tuition, Social Studies Tuition, Geography, History Tuition and Secondary Economics Tuition. For Primary Tuition, we have Primary English, Math and Science Tuition. Call 9658 5789 to find out more.